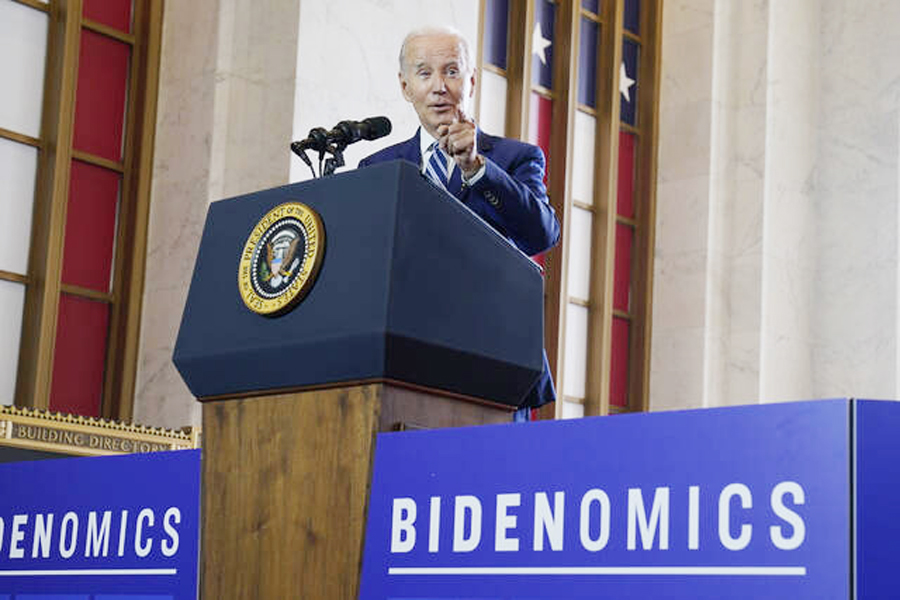

Regardless of general GDP development, the share of wealth held by the highest 1 per cent has been growing in lots of nations. Evidently the continuation of the trickle-down path is now not the answer to assist the underside and center layers. Therefore, the president of america of America has been after Bideonomics.

To construct the financial system “from the center out and the underside up as an alternative of simply the highest down” is the core thesis of just lately touted Bideonomics. As most voters are within the center and backside layers, invariably, all leaders of democracies promise “Bidenomics.” However, they typically fail to ship and find yourself serving “trickle-down economics”– chopping taxes for the rich and firms to encourage non-public funding for job creation. What’s the underlying trigger? Why can we not discover a answer to empower the mass inhabitants to drive prosperity? Is the mandate to ship (outcomes) inside 5 years a barrier? Or, is the lack of knowledge of empowering the center and backside to create new wealth a constraint?

There was rising inequality in most nations; the abstract measure of revenue inequality, often called the Gini index, has grown in lots of nations. For instance, in line with the human improvement index, Bangladesh’s Gini index elevated from 0.655 in 2020 out of 1 to 0.661 in 2022. Therefore, there was an urgency to drive financial development worldwide whereas lowering inequality.

It seems many economists imagine that governments ought to depart markets free to generate the utmost quantity of wealth, after which repair the inequality that outcomes from taxation and transfers. The thought of concentrating cash in just a few fingers certainly prompts non-public funding within the financial system, offering extra jobs, however it fuels monopolistic market energy, making a barrier to the subsequent wave of artistic destruction–resulting in stagnation and rent-seeking. Prosperity from concentrating cash in just a few corporations, having monopolistic market energy not solely drives the financial system to stagnation, however extra importantly, it dangers affected by the destruction of prosperity as a result of rise of artistic destruction waves from outdoors the border.

There isn’t a denying that firms are the brand new model of historic robber barons. The three iconic US robber barons particularly Andrew Carnegie (metal), Cornelius Vanderbilt (steamboat), and John D. Rockefeller (oil) are the results of the commercialisation of the cumulative impact of concepts. Such an final result seems pure within the race to use concepts by means of incremental advancement–resulting in monopolisation and worth setting functionality, inflicting deadweight loss.

The problem is to empower the center and backside to create financial worth from the cumulative impact of concepts. And such circulate ought to result in artistic destruction pressure to the monopolistic market energy of incumbent robber barons. Empowering people and small corporations to create such an impact seems to be a big problem.

Empowering the center and backside is not going to solely cut back inequality, extra importantly, it should open the opportunity of driving a brand new wave of development by means of concepts of artistic destruction. For instance, the concept of the LED mild bulb pursued by a small Japanese agency, Nichia, has provided a greater various, inflicting artistic destruction to the lighting enterprise of American mighty Normal Electrical. In response to the core thesis of Why Nations Fail, by Daron Acemoglu & James A. Robinson, concepts driving artistic destruction, inflicting wealth annihilation of incumbent monopolies have been on the core of financial prosperity.

As incumbent monopolies stay busy benefiting from the maturity of present waves, typically, new entrants from the underside or center drive into new waves providing higher options for getting jobs finished. For instance, whereas IBM was benefiting from mainframe computer systems, private laptop startups like Apple or Microsoft drove a brand new wave of computing, growing the attain and advantages. Equally, in providing a greater various of imaging at much less value, Sony promoted a digital digicam wave destroying the wealth accumulation of Kodak’s shareholders. Therefore, empowering new entrants residing on the backside and center is crucial to driving financial development.

However the place is the problem to empower the underside and the center? Will not be funding in infrastructure, schooling, R&D, and antitrust legal guidelines adequate? Sadly, no. Let’s look into the case of Canada, Australia, and New Zealand. These nations have wonderful infrastructure, schooling programs, and public R&D infrastructures. Their antitrust legal guidelines are additionally useful to restrict the market energy gained by means of collusion. However why are we not observing the rise of recent waves of artistic destruction forces from these nations? Alternatively, Japan, adopted by Taiwan, has succeeded in unfolding a collection of reinvention waves, destroying monopolies or robber barons of the USA and Europe.

The rise of recent waves from the center and backside calls for systematic exploitation of concepts. The rise of huge waves typically takes help for extended durations. For instance, the rise of digital cameras took greater than 15 years. Equally, LED lighting wanted 50 years. Therefore, displaying outcomes inside 5 years limits democratic leaders’ capability to empower the center or the highest to gas a artistic wave of destruction. Therefore, residents must be educated concerning the problem of nurturing new waves rising from the center and backside.

However what about quite a few people and really small corporations? How one can empower hundreds of thousands of them to create new wealth and jobs? Along with fueling the artistic wave of destruction, there’s a scope for systematically pursuing incremental concepts and grassroots improvements. To take advantage of this window of development for lowering inequality, the main focus must be on getting jobs finished, utilizing know-how potentialities, nurturing creativity, and creating a scientific capability to pursue concepts for creating cumulative results.

Sarcastically, these succeeding from the center or backside as a pressure of artistic destruction can even emerge as new robber barons. We’d like the subsequent artistic destruction pressure to destroy their monopolistic market energy. Therefore, the problem of governance (Bidenomics) has been to maintain fueling wave after wave, unfolding artistic destruction pressure from the underside and center.

Moreover, robber barons created by means of the innovation race, making merchandise higher and cheaper by means of the cumulative impact of concepts, are prevalent in trendy Western society. However many much less developed nations are affected by the curse of robber barons created by means of monopolistic particular licences, subsidies, capability charges, land grants, preferential loans, mortgage defaults and write-off, tax differentials, money incentives, and non-competitive public procurement practices. To drive development from the center and backside, much less developed nations would require methods to curtail nationwide assets and labour extraction by the robber barons created by means of preferential insurance policies.

M. Rokonuzzaman, Ph.D is tutorial, and researcher on know-how, innovation and coverage.

[email protected]